5 Steps to Rebuild My Credit

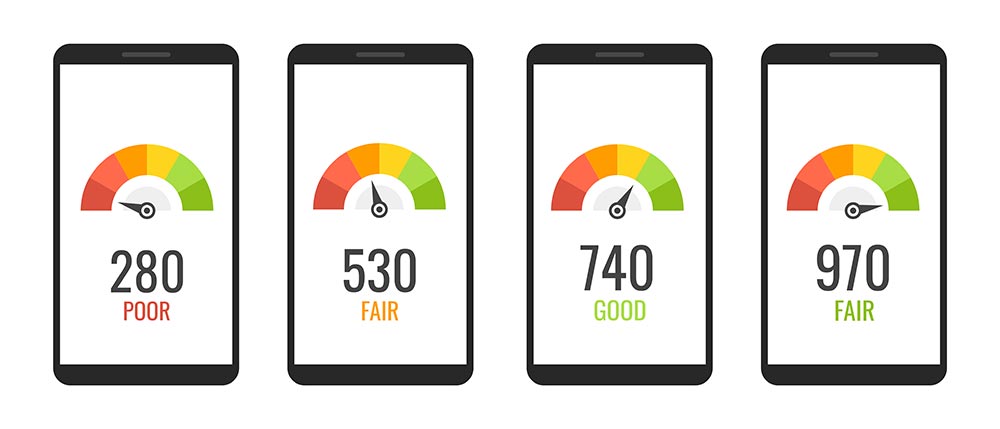

What can I do to rebuild my credit? Many people with a very low credit score ask themselves this question and don’t know where to start to rebuild their score with a bad credit report.

Here are the 5 steps to follow to achieve this effectively and without wasting time.

Pay your bills by the deadlines

Before you can even think about recovering points on your credit score, you first need to stop losing them, in particular by paying your bills on time. Make sure to always pay your bills and credit card statements by the deadlines to avoid any late payments. Any delay makes your credit score fall immediately, and it will then take you several months to recover the lost points.

Avoid bouncing cheques

Besides the fees and possible legal consequences that they can cause, bounced cheques can doubly affect your credit rating. Indeed, not only does your bounced cheque appear on your credit report, but if it was also used to pay off a debt, this incident will also appear on the report and have an impact on your score.

Refrain from making new loan applications

Applications that let you take out a loan affect your credit rating, even if no follow-up is given to them. If you’re looking to rebuild your credit, it’s therefore necessary to avoid filling out loan applications, especially since multiple loan applications are considered by financial institutions as a lack of stability in your situation and as a sign of the difficulties that you encounter in obtaining a loan.

Limit your credit card use

Using your credit cards can affect your rating, but it can also help improve it. Indeed, on one hand, if you use your cards to the maximum of the authorized limit, this is interpreted by financial institutions as an inability to limit your reliance on credit; in other words, your management is bad.

On the other hand, if you regularly make your monthly payments, you show that you are a good payer. And if you also pay more than the minimum required and you limit your credit card use to half of the amount authorized, you earn points, because you are considered a good manager.

Take out a secured credit card

Besides keeping a low profile, which helps rebuild your credit rating over a long period, it’s possible to speed up your recovery of points by using a secured credit card. People who don’t or no longer have access to credit, in particular as a result of payment defaults, can indeed obtain a so-called “secured” personal loan, a line of credit, or a credit card by paying a guaranteed deposit in the same amount as the financial institution. This procedure lets you use a credit card and thereby regain points, as long as you use it wisely—that is, only use the card up to half of the limit and always pay your bills on time. After one year of incident-free use, you should even be able to apply for a traditional credit card and recover your deposit.

Rebuilding your credit requires patience and flawless management. However, if you follow these steps seriously, you will be able to improve your credit score faster and even—over time—obtain a mortgage.